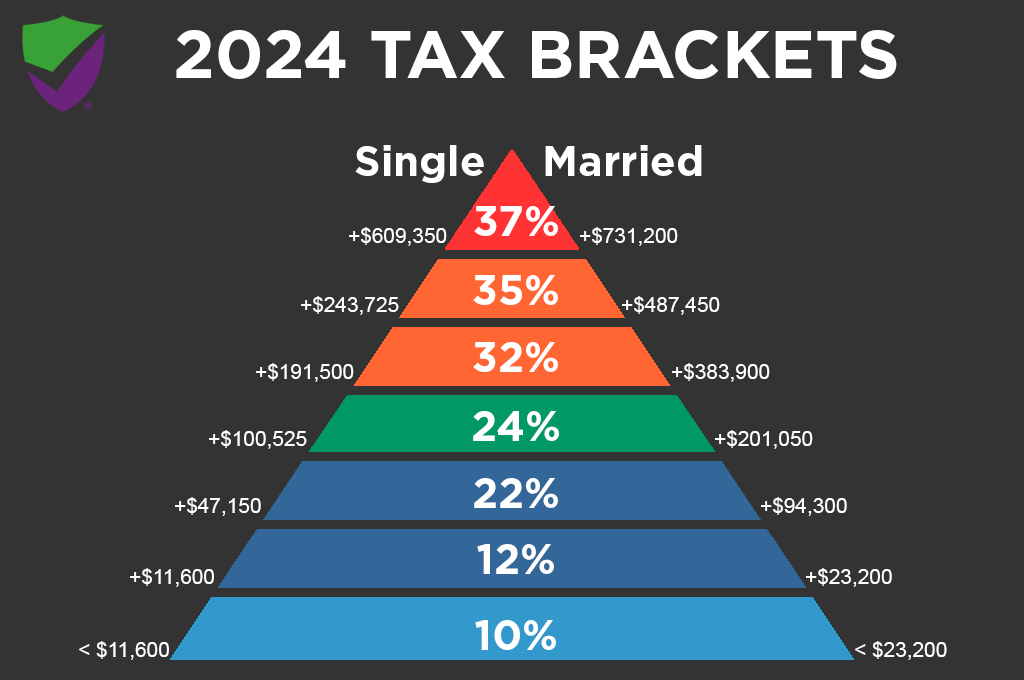

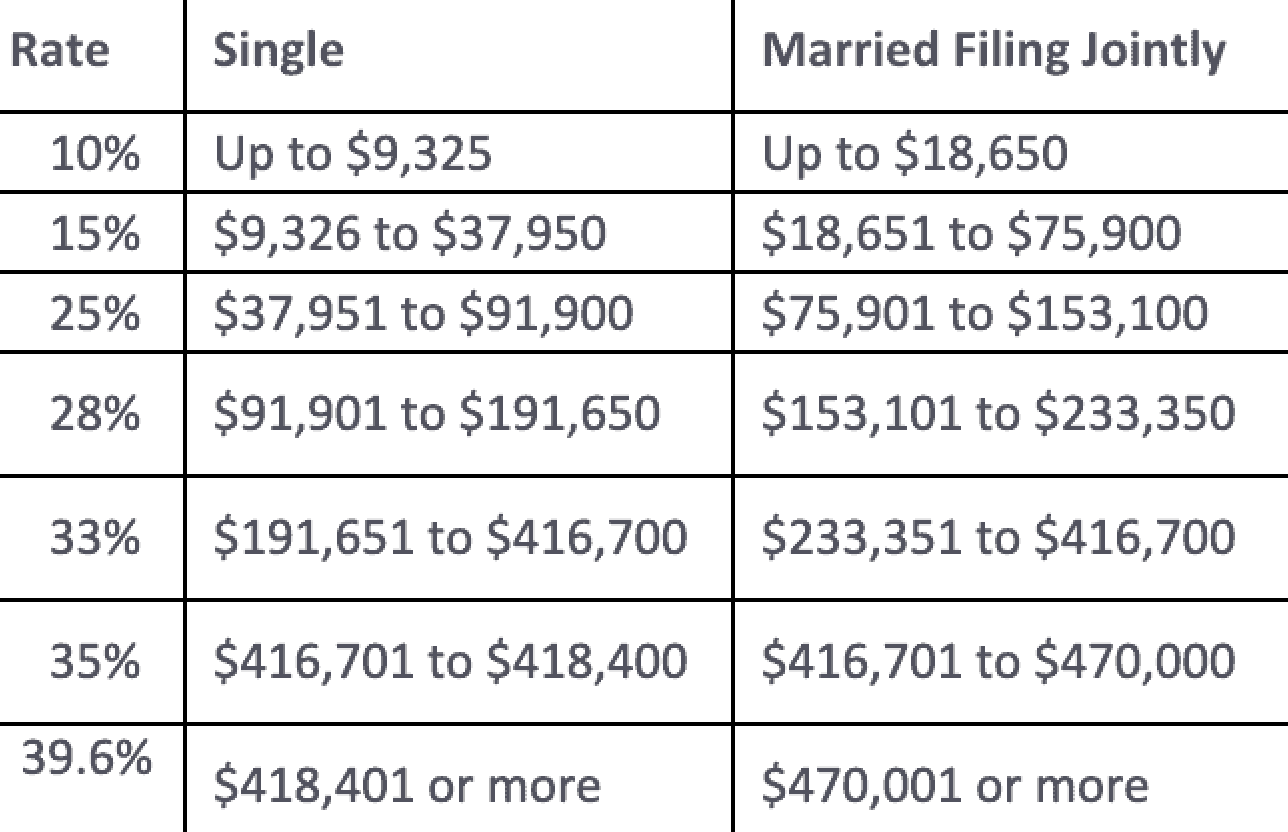

Irs 2025 Tax Brackets Irs. 10%, 12%, 22%, 24%, 32%, 35% and 37%. Irs provides tax inflation adjustments for.

For all 2025 tax brackets and filers, read this post to learn the income limits adjusted for inflation and how this will affect your taxes. Your bracket depends on your taxable income and filing status.

IRS 2025 Tax Brackets, Heads of households will see their standard deduction jump to $21,900 in 2025, up from $20,800.

Tax Brackets 2025 Federal Irene Leoline, The internal revenue service has announced the tax brackets and rates for the 2025 tax year.

Tax Tables 2025 Irs For Head Of Household Josy Odilia, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

What Will Be The 2025 Tax Brackets Sara Wilone, The irs on thursday announced higher federal income tax brackets and standard deductions for 2025.

IRS Tax Brackets 2025, Federal Tax Tables, Inflation Adjustment, The irs is introducing new income limits for its seven tax brackets, adjusting the thresholds to account for the impact of inflation.

2025 IRS Tax Brackets and Standard Deductions Optima Tax Relief, Learn how marginal tax rates work, see tables for all filing statuses, and understand changes from 2025.